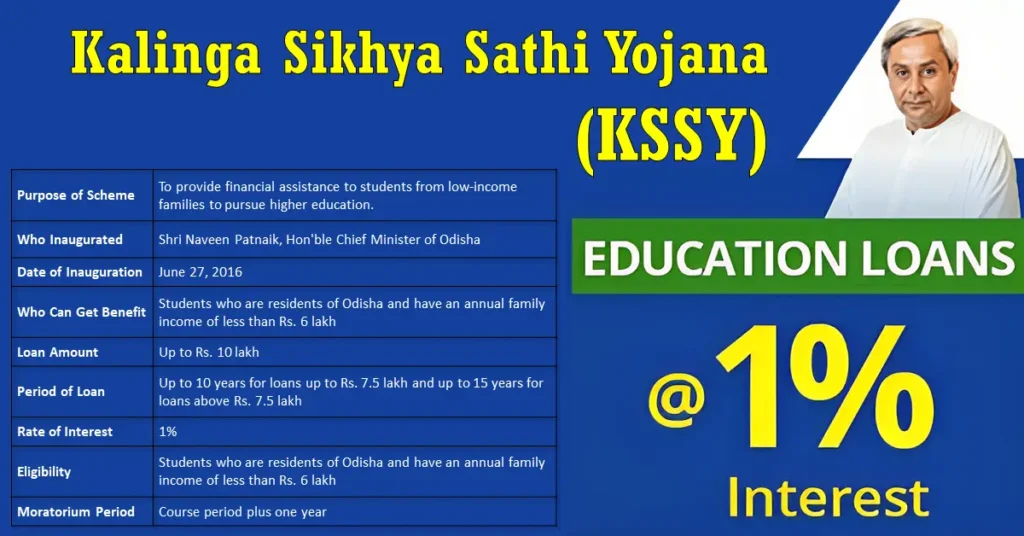

Kalinga Sikhya Sathi Yojana: In a significant move to support the dreams of aspiring students, the Odisha Government introduced the Kalinga Sikhya Sathi Yojana (KSSY), an Educational Loan program offering an unprecedented 1% interest rate. This visionary initiative was inaugurated by the Hon’ble Chief Minister of Odisha, Shri Naveen Patnaik, on June 27, 2016, with the primary aim of alleviating the financial burden on parents who aspire to provide their children with higher education.

Key Features of Kalinga Sikhya Sathi Yojana

Accessible Financial Support for Higher Education; Under the Kalinga Sikhya Sathi Yojna, students have the opportunity to secure loans for pursuing higher education from scheduled banks, with loans extending up to 10 lakhs Indian Rupees for their chosen courses.

Loan Amount

- Maximum Loan: The scheme permits students to avail a maximum educational loan of 10 lakhs Indian Rupees.

- No Minimum Loan: There is no minimum loan amount stipulated, meaning that students can secure any amount of loan they require, up to the ceiling of 10 lakhs Indian Rupees.

Loan Repayment

The KSSY offers flexible repayment options:

- For loans up to 7.5 lakhs, the repayment period extends up to 10 years.

- Loans exceeding 7.5 lakhs and up to 10 lakhs have a repayment period of 15 years.

Interest Rate

One of the standout features of Kalinga Sikhya Sathi Yojna is the incredibly low interest rate. Students availing the loan need to pay just 1% interest on the loan amount. The remaining interest amount is subsidized by the Government of Odisha, Higher Education Department.

Eligibility Criteria for KSSY

Who Can Benefit from KSSY?

To be eligible for this program, students must meet the following criteria:

- Residency: The student should be a resident of Odisha.

- Family Income: The annual income of the student’s family should not exceed 6 lakhs per annum.

- Loan Terms: The terms and conditions of the loan will be determined by individual scheduled banks. Loan applications will be processed as per the banks’ regulations.

Supporting the Underprivileged

An Inclusive Approach to Higher Education; KSSY warmly welcomes economically disadvantaged students who aspire to pursue higher studies. This program extends a helping hand to such students in their educational journey.

Moratorium Period Benefits

Making Education More Accessible; Traditionally, education loans include a moratorium period equal to the course duration plus one year, as decided by the banks. However, KSSY stands out by offering interest subvention during the repayment period, including the moratorium period following course completion. This unique feature greatly benefits the students, making higher education more accessible and affordable.

How to Apply

To apply for the KSSY, students need to visit the website of the Department of Higher Education, Government of Odisha. On the website, they will find a link to the online application form for the scheme.

To fill out the application form, students will need to provide their personal details, academic details, and family income details. They will also need to attach copies of relevant documents, such as their admission letter, income certificate, and mark sheets.

Once the application form is submitted, it will be processed by the Department of Higher Education. If the student is eligible for the scheme, they will be issued a loan sanction letter. They can then take the loan sanction letter to any scheduled bank in Odisha to get the loan amount.

Online Apply Link: CLICK HERE.

List of Banks participated in KSSY

Kalinga Sikh Sathi Yojana (KSSY) educational loan scheme in Odisha is available through various scheduled banks. Some of the banks that commonly participate in the educational loan schemes of the Government of Odisha include:

| SL No | Bank Name |

|---|---|

| 1 | Allahabad Bank |

| 2 | Andhra Bank |

| 3 | Bank of Baroda |

| 4 | Bank of India |

| 5 | Bank of Maharashtra |

| 6 | Bharatiya Mahila Bank |

| 7 | Canara Bank |

| 8 | Central Bank |

| 9 | Central Bank of India |

| 10 | Dena Bank |

| 11 | IDBI Bank |

| 12 | Indian Bank |

| 13 | Indian Overseas Bank |

| 14 | Oriental Bank of Commerce |

| 15 | Punjab & Sind Bank |

| 16 | Punjab National Bank |

| 17 | State Bank of Bikaner & Jaipur |

| 18 | State Bank of Hyderabad |

| 19 | State Bank of India |

| 20 | State Bank of Mysore |

| 21 | State Bank of Travancore |

| 22 | Syndicate Bank |

| 23 | UCO Bank |

| 24 | Union Bank of India |

| 25 | United Bank of India |

| 26 | Vijaya Bank |

| 27 | Axis Bank Ltd |

| 28 | Bandhan Bank |

| 29 | City Union Bank |

| 30 | DCB |

| 31 | Federal Bank |

| 32 | HDFC Bank |

| 33 | ICICI Bank |

| 34 | IndusInd Bank |

| 35 | Karnataka Bank |

| 36 | Karur Vysya Bank |

| 37 | Kotak Mahindra Bank |

| 38 | Laxmi Vilas Bank |

| 39 | Standard Chartered Bank |

| 40 | The South Indian Bank Ltd |

| 41 | Yes Bank |

| 42 | Orissa State Co-op. Bank |

Key Points of KSSY

| Feature | Kalinga Sikhya Sathi Yojana (KSSY) |

|---|---|

| Scheme Name | Kalinga Sikhya Sathi Yojana (KSSY) |

| Purpose of Scheme | To provide financial assistance to students from low-income families to pursue higher education. |

| Who Inaugurated | Shri Naveen Patnaik, Hon’ble Chief Minister of Odisha |

| Date of Inauguration | June 27, 2016 |

| Who Can Get Benefit | Students who are residents of Odisha and have an annual family income of less than Rs. 6 lakh |

| Loan Amount | Up to Rs. 10 lakh |

| Period of Loan | Up to 10 years for loans up to Rs. 7.5 lakh and up to 15 years for loans above Rs. 7.5 lakh |

| Rate of Interest | 1% |

| Eligibility | Students who are residents of Odisha and have an annual family income of less than Rs. 6 lakh |

| Moratorium Period | Course period plus one year |

| Official Website | https://dhe.odisha.gov.in/ |

| More Govt Scheme | Odisha Govt Scheme |

Conclusion

Empowering the Future Leaders of Odisha.

In conclusion, the Kalinga Sikhya Sathi Yojna is a groundbreaking initiative that supports the educational aspirations of the youth of Odisha. With its remarkably low interest rate, flexible repayment terms, and a focus on uplifting underprivileged students, this scheme empowers the future leaders of the state and paves the way for a brighter and more educated Odisha.

from Free Jobs Alert Odisha https://ift.tt/7NsobmT